IPO Market 2025: Cautious Optimism Amidst Selective Growth

The IPO market is stirring back to life. Analysts predict 2025 could rival 2024’s performance, but challenges persist. Let’s break down the trends, data, and expert insights shaping this year’s landscape in the article “IPO 2025 Analysis: Hope, Risks, and What Investors Need to Know”

Stock Investment Disclaimer

The information provided here is for educational and informational purposes only. It does not constitute financial advice, investment recommendation, or an endorsement of any security, company, or strategy.

- Risks Involved: Stock market investments carry inherent risks, including capital loss. Past performance does not guarantee future results.

- No Guarantees: Opinions, data, or analysis shared are subject to change without notice. Sharebaz does not assure accuracy, completeness, or timeliness of the information.

- Do Your Own Research (DYOR): Always consult a SEBI-registered financial advisor before making investment decisions.

- Compliance: This content adheres to SEBI guidelines but is not a substitute for professional advice.

- Conflict of Interest: Sharebaz or its affiliates may hold positions in mentioned securities.

Investments in securities markets are subject to market risks. Read all related documents carefully before investing.

2024 IPO Performance Recap

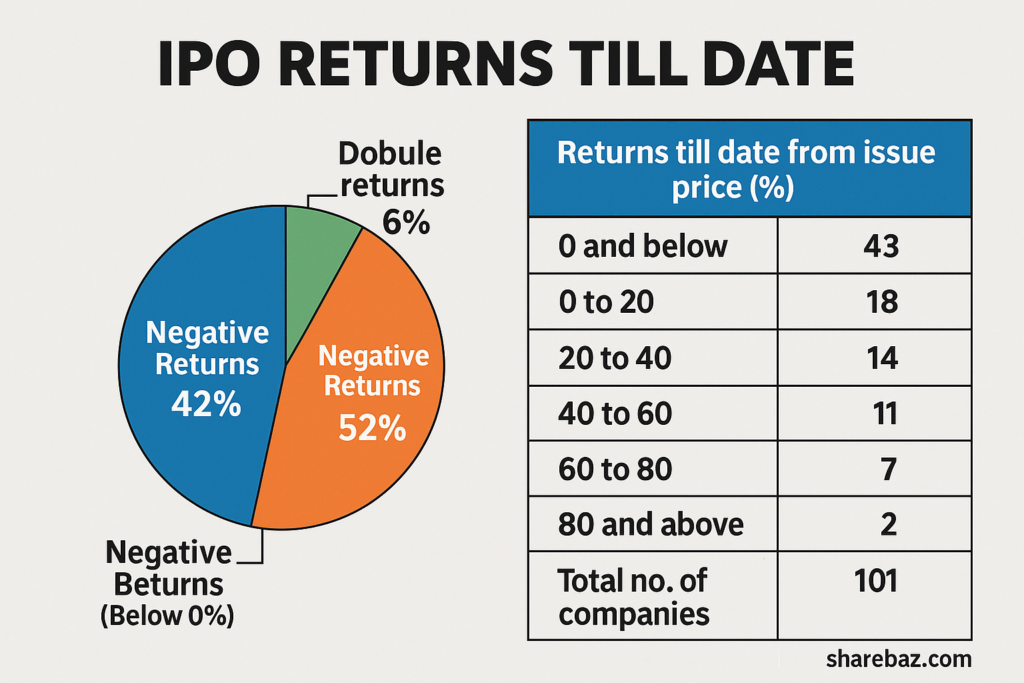

A Sharebaz analysis of 101 IPOs since January 2024 reveals mixed results:

- 58% delivered positive returns.

- Only 6% doubled gains post-listing.

- 42% underperformed, including high-profile names.

Top Underperformers (as of May 2025):

| Company | Return (%) |

|---|---|

| Ola Electric | -32.74 |

| Swiggy | -20.14 |

| Hyundai | -7.12 |

| NTPC Green Energy | -4.64 |

Top 2024 IPOs by Size:

| Company | Issue Size (₹ crore) | Issue Price (₹) |

|---|---|---|

| Hyundai Motor India | 27,858.75 | 1,960 |

| Swiggy | 11,327.43 | 390 |

| NTPC Green Energy | 10,000 | 108 |

You may also like HDB Financial Services IPOs Risks

IPO 2025 Trends: Slow Start, Brighter Horizons

2025 began cautiously:

- Jan-Feb 2025: 9 IPOs.

- March-April 2025: Just 1 IPO.

- May 2025: 7 IPOs launched, with more expected in June.

Nirav Karkera: “Last year ended with a few big IPOs, but many others were shelved. Firms now see improving conditions and are warming up to return.”

Despite muted enthusiasm, sectors like renewable energy and quick commerce remain investor favorites. High-profile names like Reliance Jio, LG Electronics, and fintechs Groww and PhonePe are eyeing 2025 listings.

IPO 2025 Expert Insights: Valuation Realities

Deepak Jasani: “Merchant bankers often prioritize high valuations to secure mandates. This can overshadow long-term investor outcomes.”

Nirav Karkera: “Even strong fundamentals struggle post-listing. Swiggy and Hyundai had massive hype but couldn’t sustain momentum.”

Standout Performers

| Company | Return (%) |

|---|---|

| Jyoti CNC Automation | 267.27 |

| KRN Heat Exchanger | 251.64 |

| Bharti Hexacom | 193.41 |

IPO 2025 analysis: Market Sentiment & Challenges

- Global Risks: US tariffs and geopolitical tensions weigh on sentiment.

- Valuation Concerns: India’s 20.3x forward P/E reflects growth expectations, but profitability matters.

- Investor Behavior: Retail/HNI demand hinges on grey market signals, while institutions tolerate slight valuation stretches.

Deepak Jasani: “Retail investors lack tools to assess valuations deeply. They chase hype but exit quickly if sentiment dips.”

The Road Ahead

- Pipeline: 49 companies aim to raise ₹84,000 crore; 67 seek SEBI approval for ₹1,02,000 crore.

- Sectors to Watch: Renewable energy, fintech, and quick commerce.

Nirav Karkera: “Conditions aren’t perfect but are conducive. Firms reinvesting in growth will lead the charge.”

Key Takeaway: Discipline is critical. Focus on companies with clear profitability paths—speculative plays face resistance.

Data as of May 22, 2025. Sources: Sharebaz, Prime Database.

Stay informed. Invest wisely.

source: moneycontrol.com